Whenrunning an ecommerce business, it’s easy to overlook the importance of accounting. However, understanding your numbers is crucial for long-term success. How do you determine whether your business is generating more revenue than expenses? Or what activities are most profitable for your company? Ecommerce accounting can give you answers to these questions and more.

What is ecommerce accounting?

Ecommerce accounting involves recording, organizing, and managing all financial data and transactions for an ecommerce company. It is a specialized subset ofsmall business accountingcreated to meet the unique needs of ecommerce merchants.

在其核心,会计包括跟踪和美食gorizing transactions as income or expense. While this may sound simple, accounting terminology can be overwhelming, especially if you’re new to business finances.

Let’s look at the key components of ecommerce accounting:

- Purchase order:A purchase order is a legally binding document prepared by clients to specify the desired type and quantity of items for purchase.

- Sales order:Prepared by the seller in response to a purchase order, a sales order outlines all the necessary details of a sale, including goods description, sale amount, quantity, payment information, and delivery date and address.

- Cost of goods sold (COGS):COGS represents the total cost involved in producing and distributing a product. It comprises expenses like warehousing, shipping, and credit card fees directly related to selling products (excluding overhead expenses).

- Ecommerce sales tax: This is the tax that ecommerce merchants pay to the purchaser’s resident state. It’s only applicable when a sales tax nexus exists between the state and the seller, i.e., the state has the right to tax the company.

- Accounts payable and accounts receivable:Accounts payable refers to outstanding bills and invoices, while accounts receivable represents the total amount of expenses and revenue awaiting payment.

What does ecommerce accounting include?

Ecommerce accounting, like all business accounting, includes:

- Basicbookkeeping functions, like balance sheets, invoicing, and payroll.

- Advanced planning and reporting functions, like creating a strategic tax plan.

It places major emphasis on three key areas:

Bookkeeping

Accurate bookkeeping forms the foundation for business planning and operations. It comprises essential tasks such as managing inventory, categorizing income and expenses, and reviewing balance sheets.

It also trackscustomer returns, which may at times pose challenges if not recorded accurately. An ecommerce accounting system should accommodate customer returns and accurately record them without throwing off your financial reports.

Tax management

Accounting firms offer tax management services to address the potential consequences of mistakes in filing or interpreting the tax code. In ecommerce, tax management involves calculating and filing quarterly estimated taxes, completing year-end filings, distributing 1099s to contract workers, and tracking and remitting state and local taxes.

Determining when an ecommerce seller must charge sales tax is complex, as different states have different rules. Typically, sellers with substantial business in a state (sales tax nexus) are responsible for collecting and remitting state taxes for purchases made within that state.

An ecommerce company always has a sales tax nexus in the state where it is headquartered. Other triggers include exceeding specific sales thresholds in particular states, attending trade shows, having a physical location or warehouse, or employing staff or shipping partners in a state.

Growth planning

Scaling a business is an exciting journey, and ecommerce accounting plays a pivotal role beyond being a mere administrative task. It serves as a powerful tool for gathering crucial information to propel your business toward its goals.

With ecommerce accounting, you can:

- Identify the most profitable products or services for your company

- Track your largest expenses and liabilities

- Monitor the changes in your profit over time

- Discover opportunities to optimize yourprofit margins

Accounting methods for ecommerce businesses

Accounting providers exist in various forms—ranging from traditional accounting firms to accounting software platforms. But before you get started with a vendor, it’s essential to decide on an accounting method.

Two options are available: cash basis accounting and accrual accounting. An ecommerce company can opt for either method, but not both simultaneously.

Cash basis accounting

Cash basis accounting is an accounting method that measures the transfer of cash.

Let’s say you run an electronics store and receive an order for a $500 smartphone. After shipping the product to the customer, you would record the income from the sale only when the customer’s payment is received and deposited into your account.

The same principle applies to expenses. Let’s suppose you have an outstanding invoice for $1,200 from a web designer for website updates. If the payment is still pending by the end of the quarter, you would be liable to pay taxes on that amount, even though it hasn’t been settled. In cash accounting, the expense is recognized when the money is actually disbursed from your account.

Accrual accounting

Accrual accounting is an accounting technique that records transactions when they are incurred or earned rather than when cash is exchanged.

Consider a scenario where you operate a business that manufactures and sells custom-made furniture. Under accrual accounting, when you complete a high-end dining table worth $3,000 for a customer, you recognize the revenue of $3,000 immediately, even if the payment hasn’t been received yet.

This approach provides a more comprehensive view of your business’s financial status in the long run. However, it’s important to note that despite recognizing the revenue, your business bank account may not reflect the immediate inflow of funds.

Best ecommerce accounting software

Here’s a list of the top small business accounting software you can choose for your ecommerce business.

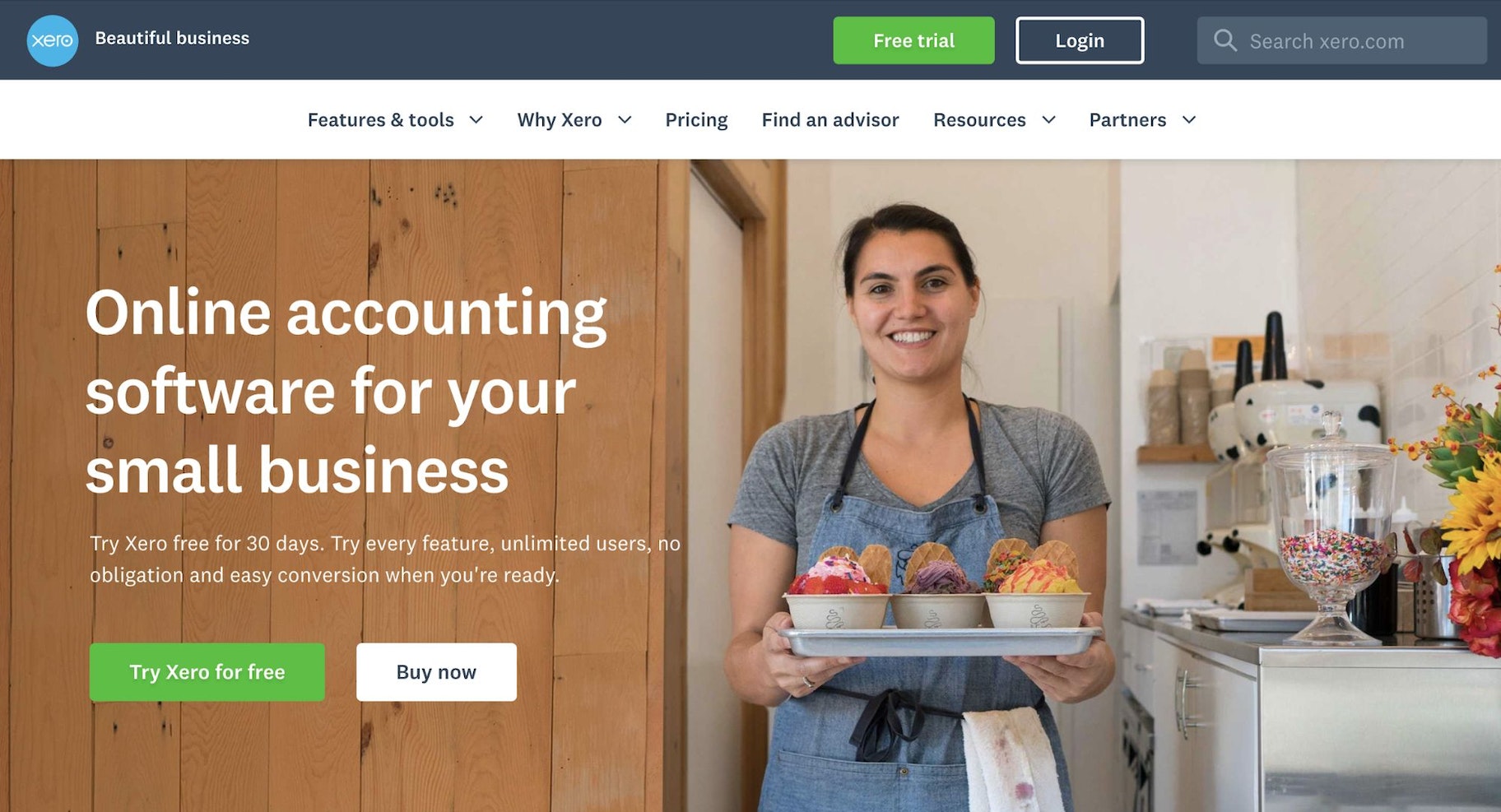

Xero is a cloud-based accounting software solution for small and medium-sized businesses. It provides a comprehensive suite of features, including more than 800 integrations, customizable invoicing, double-entry bookkeeping, and budgeting support. With Xero, you can have as many users as you need, with different account control levels.

QuickBooks Online automates accounting processes for ecommerce businesses. It integrates with popularsales channelslike Shopify, eliminating manual entry and ensuring accurate sales tracking across multiple stores. With features such as automated tax management, smart revenue matching, and trend analysis, QuickBooks Online simplifies your financial management.

Zoho Books offers a single, secure location for managing your bookkeeping tasks. With this software, you can handle your company’s invoices, reconcile bank statements, and manage spend control all in one place. Automated workflows facilitate task prioritization and streamline operations by providing in-app notifications, field updates, and more.

Ecommerce accounting best practices

Accounting rules tend to vary by country and state, making it crucial to stay up to date. Even if you’re not proficient in accounting, following a few simple guidelines can help ensure a smooth ecommerce operation.

For both new and experienced online store owners, here are some accounting best practices to consider:

Practice good bookkeeping

Balancing your books is key to effective ecommerce accounting. Record all financial transactions accurately, including income, expenses, purchases, and sales. This way, you’ll have a clear understanding of your financial health.

Regularly reconcile accounts

Develop a habit of frequently comparing financial records with bank statements to ensure accuracy. This can help you identify and rectify any errors before they pose serious threats.

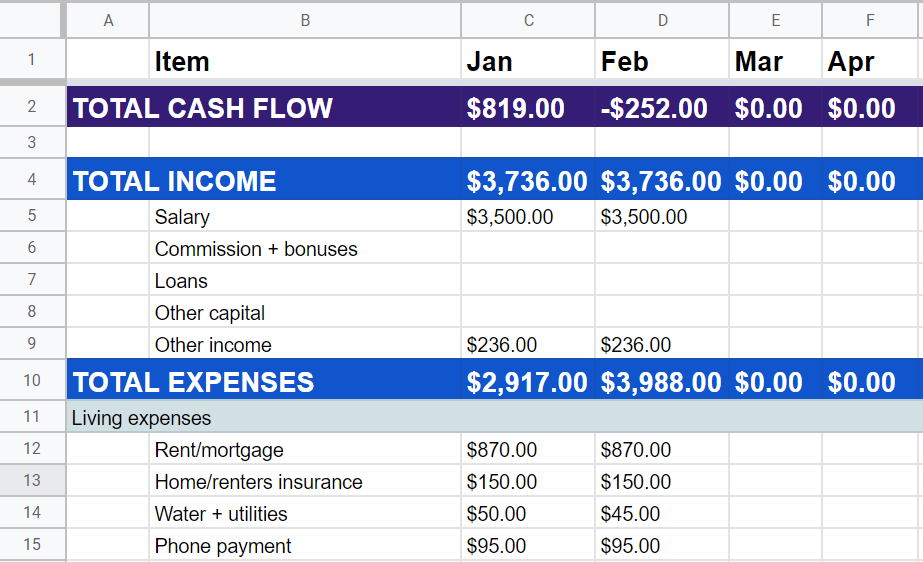

Monitor cash flow

Keep a close eye on incoming and outgoing funds. If the cash flow is positive, you have a financially healthy business. But if the cash flow is negative, you need to address it promptly.

Understand sales tax

Sales tax can be intricate for ecommerce businesses, particularly when selling to customers in different states or countries. Familiarize yourself with your obligations and ensure accurate collection and remittance of the appropriate sales tax amounts.

Use an ecommerce accounting software

Many accounting software solutions integrate withecommerce platforms. These systems can help reconcile and manage your sales, expenses, and inventory.

Embrace automation

Leverage technology to automate various accounting tasks. Software can assist in sending invoices, tracking sales, and even calculating taxes on your behalf. This saves time and minimizes the risk of accounting errors.

Maintain inventory control

Effective inventory management is critical for ecommerce businesses. You need to know what’s selling, what isn’t, and what you have in stock. Check if your accounting software includes inventory tracking or consider using a dedicated inventory management tool to streamline the process.

Take control with ecommerce accounting

Now that you have a better understanding of ecommerce accounting, you can confidently navigate the financial aspects of your business. Just remember that you don’t have to go it alone. With ecommerce accounting software, you can track sales, record expenses, calculate taxes, and do more with a few clicks.

Remember, effective accounting is a key pillar of your ecommerce venture, so prioritize it alongside other crucial aspects of your business to ensure sustained profitability and growth.

Ecommerce accounting FAQ

What are the benefits of ecommerce accounting?

Bookkeeping and accounting matter a lot for ecommerce businesses. Accurate accounting helps track cash flow and understand the financial health of the business. This allows you to make better decisions and stay compliant with regulations. Additionally, good accounting practices can reveal areas where the business can cut costs and increase profits.

How do you do accounting for an ecommerce business?

Ecommerce accounting deals with online transactions that are usually paid via credit card or other digital payment methods. Unlike regular stores, ecommerce businesses must monitor and reconcile sales, payments, refunds, and returns from various sources like Stripe and PayPal. Moreover, they must track and manage shipping, inventory, taxes, and other transactional data.

Should I hire an accountant for my ecommerce business?

It depends on what stage your ecommerce business is at. If your business is still in its early stages, you may not need an accountant. But as your business grows and you encounter tax and financial complexities, an accountant may provide valuable assistance.

What are the accounting issues for ecommerce?

Ecommerce accounting presents multiple challenges, including the need to track goods across multiple warehouses for efficient inventory management. Another complex aspect involves managing sales tax liability across various jurisdictions under “economic nexus” rules. Additionally, accurately accounting for product returns, tracking seller fees on ecommerce platforms, and facing limitations in accessing real-time analytics data contribute to the issues faced in ecommerce accounting.